Contrarian

Candle

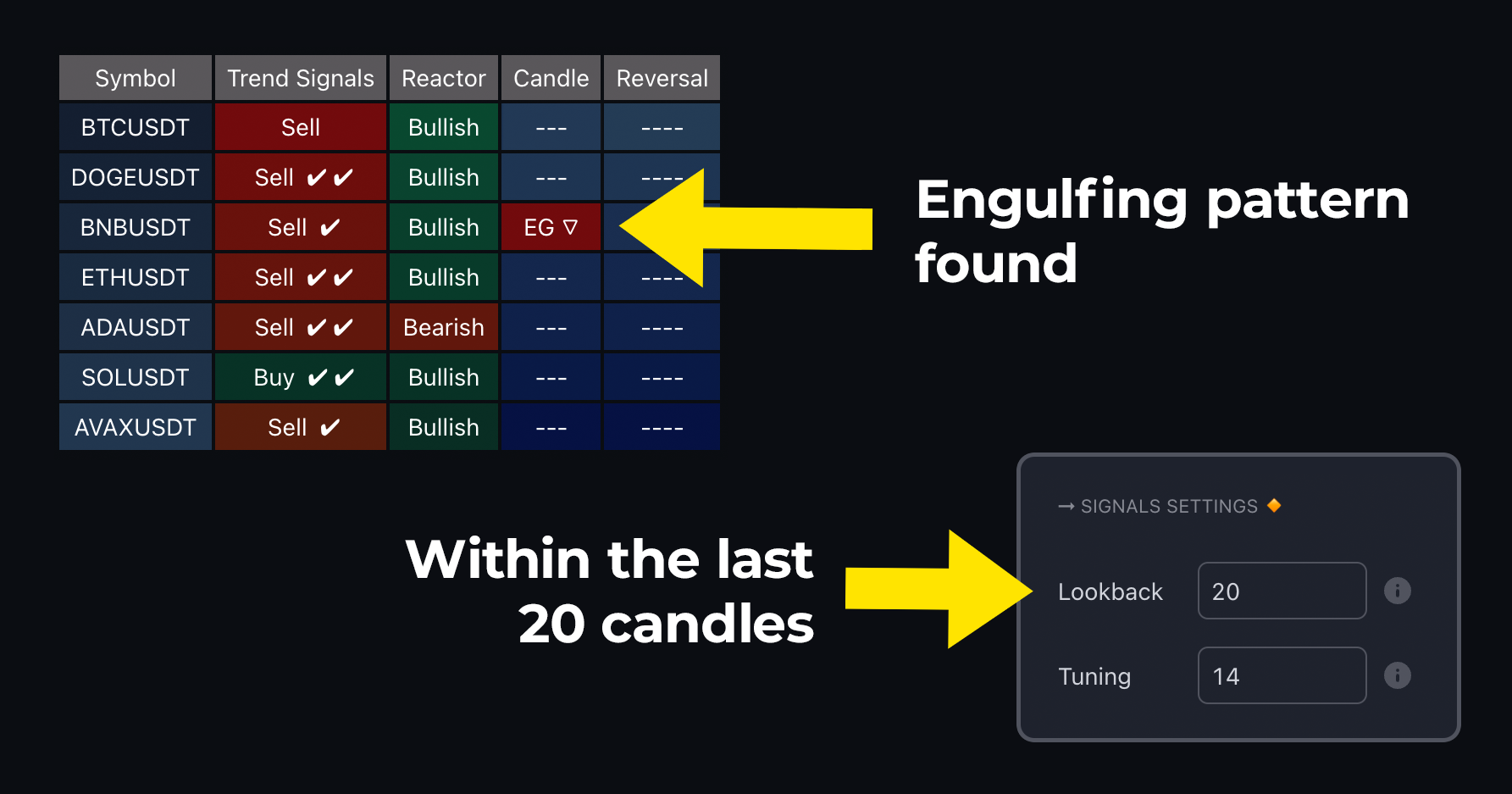

The Candle column displays the current and most recent found candle pattern as labeled in the market oracle. The screener takes an innovative approach by utilizing a lookback setting. If a pattern is detected within the specified lookback number of candles (default is 5), it will be shown in the screener. This feature increases the frequency of detected patterns, making the screener more actionable. Traders can adjust this value to 1 if they wish to screen for patterns only on the current bar.

|

|---|

| Prime Screener detecting an engulfing pattern |

As described on the candlestick patterns page:

“Candlestick structures analyze candlestick formations, putting a unique spin on classical patterns and providing the most relevant formations on the chart. These patterns are filtered through further market activity analysis, making them superb for reversal identification. They are often used in conjunction with other reversal techniques, such as support and resistance confluence. For example, if the price is at resistance and a bearish candlestick pattern appears.”

The list of patterns being screened for includes:

EG - Engulfing Patterns: The body of the candle completely eclipses the body of the previous candle.

Hammer: A reversal candlestick with a long wick, producing a hammer shape.

RTM - Rising Three Methods: A bullish continuation pattern that arises during an upward trend, suggesting the market will likely continue in a strong buy-side period.

FTM - Falling Three Methods: Characterized by two long candlesticks in the direction of the trend, with three shorter counter-trend candlesticks in between. This pattern indicates that bulls lack sufficient conviction to reverse the trend.

Bullish Soldier & Bearish Soldier: A reversal pattern consisting of three consecutive long-bodied candlesticks that open within the previous candle's real body, closing above the previous candle's high.

Evening Star & Morning Star: A reversal pattern made up of three candles: a large bullish candlestick, a small-bodied candle, and a bearish candle.

Better Entries and Exits:

Looking for scalping settings via candle patterns can be beneficial. For example, a sell signal followed by a bearish reactor and a new bearish candlestick pattern can provide an opportunity for an excellent short scalp. Candlestick patterns can also indicate profit opportunities. If a trader is in a short position and bullish candlestick patterns are being detected, it might be a good chance to take profits off the table.

Reversal

The Reversal column is a key feature of The Prime Screener, designed to help traders spot potential reversal signals in the market. This tool serves as an alert for possible changes in market direction.

|

|---|

| Reversal Signal detected |

Default Setting: By default, the screener checks the last five candles on the chart for reversal signals. If it finds something noteworthy within these candles, it displays this information. Traders can increase this value to scan over a larger range.

Adjusting for Immediate Signals: For those interested in the most current market activities, the settings can be changed to focus solely on the current candle, providing the latest information on potential market shifts.

Why It's Useful

For Quick Trading Strategies (Scalping):

If a trader sees a sell signal, a downward trend (bearish reactor), and a new pattern suggesting the trend might continue downward, this could be an ideal opportunity for a quick, profitable trade.Deciding When to Take Profits:

If a trader is in a short position and starts noticing bullish reversal signals, this might indicate a good time to take profits before the market trend reverses.

TIP:

The Reversal Column in The Prime Screener offers traders a valuable tool for identifying potential market turns. Its customizable lookback period caters to various trading needs, from immediate action to more calculated strategies. This feature ensures that traders can stay informed and make timely decisions based on the latest market trends.